Accept Campus Card Payments On or Off Campus

Today’s campus populations frequently make purchases for vending, micro-markets, parking, retail, cafeterias, and more using their campus ID cards. Whether you operate a business on or nearby a college, hospital, or employee campus, Apriva allows you to accept closed-loop payments from these ID cards. Whether you’re operating a vending machine, retail store, micro-market, or restaurant on or off campus, never miss a sale from campus populations again. In fact, our research shows that accepting campus card payments at vending machines alone on-campus increase sales by up to 25%!

College Campuses

Merchants on or near college campuses can use one payment device to accept both credit and debit, and campus card transactions. Apriva also supports payroll deduction, meaning campus employees can pay for on-campus goods and services with their employee ID card, and those purchases are deducted from payroll. Plus, college meal plans are coming soon!

Hospital Campuses

Employees have access to all hospital services and products with a swipe of their hospital ID badge, from cafeteria and food services, to uniform and equipment purchases/rentals. Plus, merchants can use one payment device to accept both credit and debit, and employee ID transactions. Apriva supports both traditional preloaded funds (declining balance), and payroll deduction!

Corporate Campuses

Employees have access to all services and products on the corporate campus with a swipe of their ID badge, from on-campus food services, to on-site healthcare or health and fitness. Plus, merchants can use one payment device to accept both credit and debit, and employee ID transactions. Apriva supports both traditional preloaded funds (declining balance), and payroll deduction!

So Many Use Cases, So Little Time!

Why Should You Accept Closed-Loop Payments?

Customer Loyalty

Merchants on or near campuses benefit from a steady customer base, with users incentivized to spend within the campus ecosystem. Meal plans and declining balances create ongoing demand, driving repeat visits, and off-campus merchants gain access to the campus community.

Increase Spending

Populations who use campus cards often view their funds as “preloaded”, reducing the psychological friction of spending. And for some campus populations – especially college campuses – this could be the only method of non-cash payment they have access to on or near campus.

Capture New Revenue

Realize a new revenue stream by tapping into campus populations, making it easier than ever for them to make purchases using their existing ID cards.

Streamline Operations

Campus card payments are typically faster, reducing wait times especially during peak hours. Gain inventory insights and simplified reporting through an integrated payment system.

Reduce Declines

Declining balance, or preloaded funds, ensures funds are available before a transaction occurs. Payroll deduction is reliable as payment is guaranteed as it is drawn from the user’s paycheck. Meal plans are also loaded in advance, ensuring consistent revenue and reduced declines.

Marketing Opportunities

Powerful transaction data from all payments – including campus cards – in one single Apriva back-office system offers insights to power data-driven marketing. Plus, you can’t put a price tag on brand visibility from becoming part of the trusted campus community.

Our Campus Card Partners

We're The Leading Payment Gateway For Campus Cards

Accept Any Way Customers Want to Pay

Credit + Debit

Type, Scan, Swipe, Dip, or Tap credit and debit cards wherever your business takes you!

Payroll Deducation

Ideal for hospital and corporate campuses that offer services and amenities to their employees.

Campus Cards

Accept campus and employee ID cards as a method of payment. This includes preloaded funds (declining balance), payroll deduction, and college meal plan (coming soon)!

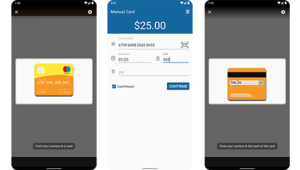

Virtual Terminal

No payment device? No problem. Scan cards using OCR technology or manually enter card information into your AprivaPay app. Merchant Studio web companion can also be used to key in payments, great for secure phone orders.

Mobile Wallets

Accept NFC Payments such as ApplePay®, Google Pay®, and Samsung Pay®.

Card Tokenization

Our Card on File tokenization and secure “card on file” capabilities allow customers to not have to show their cards at all, and allows merchants to accept card not present payment methods such as biometrics, QR codes, stored subscription information, and more.

Highest Level of Protection From Fraud

Apriva is a PCI Level 1 Service provider, Independently validated by VISA®, MasterCard®, American Express®, and the Payment Card Industry Security Standards Council™ (PCI-SSC). We are one of the only P2PE Certified Gateways in the industry. Period. Others claim P2PE, but they are “self-assessed”. We are certified by a PCI Council Auditor every 2 years. This means the odds of you being responsible for a data breach are as low as they can possibly be.

Professional Payment Services Tailored to Your Needs

Payment Services

Leverage Apriva’s payment services to meet your payment needs, from white-labeling our mobile payment apps, choosing from multiple payment acceptance methods and devices, creating custom reporting, and more.

Customer Care

Apriva provides a 24/7 live US-based customer service center for merchants and resellers. Dedicated account management and sales liaisons provide further support as your business grows with Apriva.

Integration Services

Part of Apriva’s payment services include integration services, which support Independent Software Vendors (ISVs), software developers, and app developers through the programmatic integration of secure payments.

Experience a Better Level of Service.

Contact us Today!

At Apriva, we treat you like a human, giving you 24/7 access to live US-based sales and customer support professionals. That’s the way we believe business should operate. So go ahead! Click the button below, give us a call at 877-435-3141, or email us at pos@apriva.com.