Apriva Offers Dual Pricing:

Cash Discount and Convenience Fee!

Did you know Apriva offers Dual Pricing? There are 2 ways to implement: Cash Discount (which we call “Save With Cash”) or Convenience Fee!

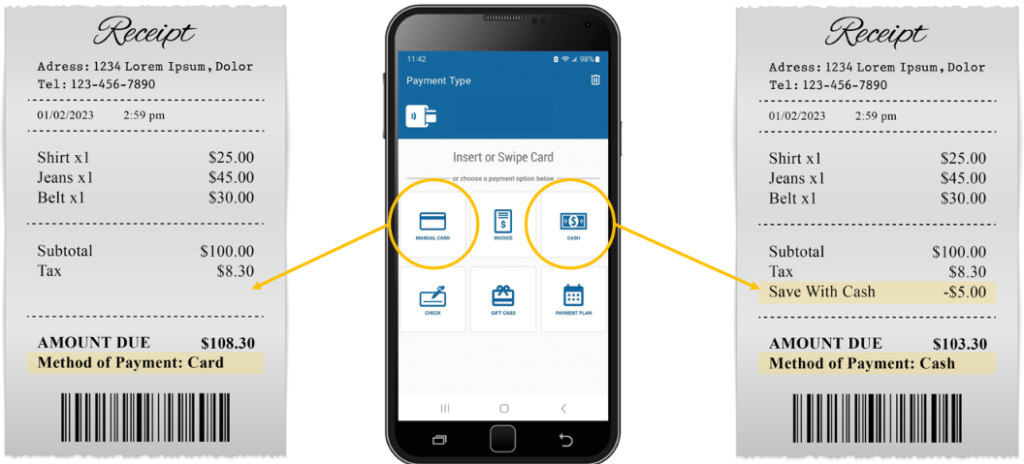

Option 1: Save With Cash (Cash Discount)

List the non-cash price on your merchandise and offer a discount if someone uses cash as their method of payment.

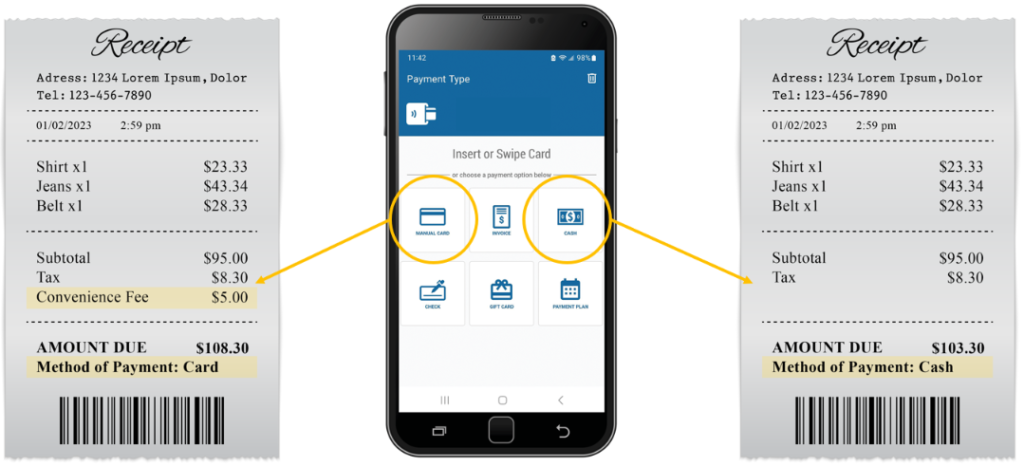

Option 2: Convenience Fee

List the cash price on your merchandise and apply an additional charge if someone uses a non-cash method of payment.

What Is Dual Pricing?

Dual pricing based on the payment method refers to the practice of offering different prices or transaction amounts to customers depending on whether they choose to pay with cash or a non-cash payment method such as credit cards, mobile wallets, or online payments. This type of dual pricing is commonly observed in various industries, including retail, hospitality, and services.

Additionally, with the increasing adoption of electronic payment methods and the rise of cashless societies, some businesses may even offer incentives or rewards for using non-cash payment methods to encourage customers to embrace digital transactions.

Merchant Benefits

Dual pricing in AprivaPay allows merchants to transparently offer different transaction amounts to consumers depending on if they pay with cash or non-cash payments.

- Choose to discount for cash payments or add a charge for card payments

- Price transparency at the point of sale

- Full control over implementation

What is a Cash Discount?

A cash discount is a pricing strategy where a seller offers a reduced price to customers who pay with cash instead of using other payment methods such as credit cards or electronic payments. It incentivizes customers to pay with physical currency by providing them with a financial incentive in the form of a discount.

Here’s how a cash discount typically works:

- Listed Price: The seller sets a standard or listed price for the product or service, which is the price customers would pay if they choose to use a non-cash payment method.

- Cash Discount: The seller then offers a cash discount, typically a percentage off the listed price, to customers who choose to pay with cash. For example, if the listed price is $100 and the cash discount is 5%, customers paying with cash would only need to pay $95.

- Payment Method Verification: The seller may verify the payment method at the time of purchase to ensure that customers are eligible for the cash discount. This can be done by confirming the use of physical currency or other acceptable cash payment methods.

The purpose of a cash discount is to encourage customers to use cash, as it eliminates the need for the seller to incur transaction fees associated with non-cash payment methods. By providing a financial incentive, businesses can reduce their costs and potentially improve their cash flow.

Benefits:

- Cost Savings: By encouraging customers to pay with cash, businesses can avoid or minimize transaction fees associated with credit card processing or other non-cash payment methods. These fees can add up, particularly for businesses with high transaction volumes, so offering a cash discount helps reduce these costs and improve profit margins.

- Improved Cash Flow: Cash payments provide immediate access to funds without delays in processing or potential chargebacks. This can help businesses manage their cash flow more effectively, ensuring faster access to revenue and potentially reducing the need for credit or loans to cover short-term cash needs.

- Customer Incentives: Cash discounts serve as an incentive for customers to choose cash as their preferred payment method. Some customers may prefer paying with cash to avoid credit card debt, interest charges, or potential identity theft concerns associated with electronic transactions. Offering a cash discount can attract these customers and strengthen their loyalty to the business.

- Pricing Transparency: Offering a cash discount promotes transparency in pricing. By clearly indicating the price difference between cash and non-cash payment methods, businesses provide customers with a clear understanding of the value they receive for paying with cash. This transparency can build trust and enhance the customer-business relationship.

- Potential Increased Sales: Cash discounts can be an attractive offer for price-conscious customers who actively seek ways to save money. By providing a discount for cash payments, businesses can potentially attract new customers or encourage repeat purchases from existing customers who appreciate the savings offered.

What is a Convenience Fee?

A convenience fee is a charge added to a transaction for the convenience of the customer to be able to use an alternative payment method from cash. Essentially, if a customer wants to use a non-cash method of payment, merchants are able to add a convenience fee for this method.

Benefits:

- Covering Costs: A convenience fee can help merchants recover expenses or costs from providing specific products and services, such as offering non-cash payment acceptance options.

- Flexibility in Pricing: allows merchants to adjust pricing based on business factors without changing the base price.

- Pricing Transparency: Convenience fees promote pricing transparency by breaking down specific costs for consumers, helping them understand what they’re paying for.

To Learn More or Get Started, Contact us Today!

It’s important to note that the practice of dual pricing based on payment methods in the United States is subject to state regulations. It is the responsibility of any merchant enabling Dual Pricing methods to research and adhere to these regulations.