How Apriva Can Lower Processing Fees and the Cost of Accepting Credit Cards For Any Size Business!

If your business is accepting credit or debit card payments, then you are paying “Processing Fees” or “Interchange Fees”. Today we’re going to learn more about what these are, and how to lower them.

Processing fees are the costs businesses pay out of their transaction volume to be able to accept credit card payments. If you want to accept credit card payments, you have to pay these fees. These fees go to the various players in the credit card network including the Card Issuing Bank, the Card Networks (Visa, Mastercard, American Express and Discover), the Merchant Acquirer and possibly the Point of Sale solution provider.

Bank Fees and Card Network fees are non-negotiable. But processing fees can be negotiated, and lowered. Who you have a relationship with, what processor you’re working with, or if you’re doing business with a Payment Facilitator (Payfac) or Merchant Acquirer vs. working directly with an Acquiring Bank (we’ll explain what this means in a moment), all effect how much you pay per transaction. In general, if your business is big enough, you can have a relationship directly with acquiring banks, which provides access to wholesale payment processing rates, saving you money over working with a Payfac or Merchant Acquirer. Small to mid-size businesses usually can’t work directly with an Acquiring Bank to lower processing fees. Until now, through Apriva.

Apriva allows any size businesses (if approved) to avoid working with Payfac’s and Merchant Acquirers (who add their own markup to processing fees), by connecting them directly to an Acquiring Bank, providing them with more security, more reliable payouts, and more affordable rates.

Benefits of working directly with Apriva for your Payment Gateway, Payment Acceptance Services, and Processing:

- Your business is the stated merchant on record with the banks and card brands, so Apriva never touches your money, it’s always yours, and it’s paid out by a Federally regulated, liquid, reliable, and trustworthy Acquiring Bank like J.P. Morgan Chase, for example.

- No extra markup on processing fees

- Single point of contact with the complex world of bank and card networks.

- Simplified and streamlined fee structures

Is your head spinning from all these terms? Let’s dive into what all of this means and how it works so you can start saving money today. Already convinced? Contact us now!

What are Processing Fees, Also Known as Interchange Fees?

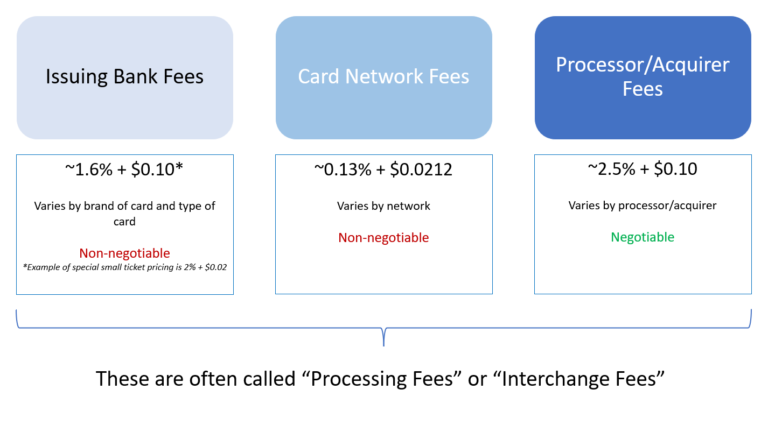

Interchange fees are transaction fees that the seller’s bank account must pay whenever a customer uses a credit/debit card to make a purchase from their business. The fees are paid to cover payment handling costs, fraud, bad debt costs, and risk involved in approving a non-cash payment. In general, interchange fees can be broken out into these 3 categories:

CATEGORY ONE: CARD ISSUING BANK FEES

The Card Issuing Bank supplies credit or debit cards to consumers. They also charge fees to businesses when the consumer uses their card. These fees vary depending on several factors, including:

- Whether or not the card is debit or credit.

- If the transaction is “Card Present” (the consumer presents the card to a merchant’s point of sale device), or “card not present” (typically an internet transaction, phone order, a subscription or recurring payment, or a “card on file” payment).

- Card type (for example, a “platinum club” card vs. a regular credit card).

In general, card-present fees from Issuing Banks are around 1.6% + $0.10 (though there is special “small ticket” pricing available for businesses like vending machine operators, which lower the per-transaction fee down to around $0.01). This means they charge 1.6% of the value of the transaction, plus $0.10 per transaction.

These fees are the same for every business, and are non-negotiable.

CATEGORY TWO: CARD NETWORK FEES

The Card Networks – VISA, MasterCard, American Express and others – charge fees for use of their networks in connecting card issuers and merchants. These companies operate a payment network that connect the banks that issue credit cards to consumers (Issuing Banks), and banks that collect money on behalf of sellers (Acquiring Banks). When the card networks “run the rails” between these entities, they’re making sure that consumers have enough credit before a purchase is approved, and wire money between the various entities. These are card network fees.

While these fees vary by network, a good average for these fees is 0.13% + $0.0212. In other words, they charge 0.13% of the value of the transaction, plus $0.0212 per transaction.

These fees are also the same for everyone, and are non-negotiable.

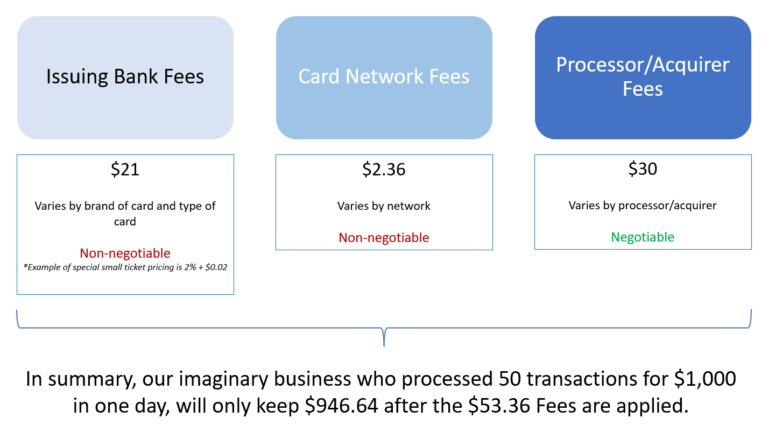

Going back to our imaginary business. If by end of business today they process 50 transactions for a total of $1,000, they will pay $21 in fees to their Issuing Bank. Here’s what the math looks like: ($1,000*1.6%)+(50*0.10)=$21. Using the same example as above, if by end of business today our imaginary business processes 50 transactions for a total of $1,000, they will pay $2.36 in Card Network Fees. Here’s what the math looks like: ($1,000*0.13%)+(50*$0.0212)=$2.36. So, their $1,000, minus the $21 Issuing Bank Fees, minus the $2.36 Card Network Fees, means...

CATEGORY THREE: PROCESSOR/ACQUIRER FEES

First, let’s distinguish what these two things are. Also, the reason these are lumped together into one category, is because often “all-in-one” payment providers, like Square and Clover, are both the processor AND the Payment Facilitator/Merchant Acquirer.

- Processing Fees: Payment proceeding fees are the costs business owners incur when processing payments from customers. The amount of payment fees charged to a seller depend on various factors, such as level of risk of the transaction, type of card, and the pricing model set by the specific payment processor they are working with (a few examples of payment processors include Fidelity, Elavon, Heartland, TSYS, and WorldPay).

- Merchant Acquirer/Payfac Fees: It is very common for businesses, especially small to medium sized businesses, to have to work with a Payfac or Merchant Acquirer. Merchant Acquirers work with merchants/businesses to enable them to be able to accept debit and credit card payments. These Merchant Acquirers (also sometimes known as a “PayFac”, are responsible for collecting the fees for the Card Issuing Banks and Card Networks, and sending the net proceeds of credit card charges back to the merchant. A merchant acquirer’s fees are negotiable. Generally, the more volume a merchant processes, the lower the fees they can negotiate with their merchant acquirer.

The average credit card processing fees range from 1.5% – 3.5% per transaction. One of the most common fees we see from these combined Processor/Acquirers is 2.5% + $0.10, so we’ll be using this for our example down below.

Good news. These fees are negotiable!

Let’s get back to the math. As we discussed earlier, many “all-in-one” payment providers, like a very popular quadrangle-named payment company, are both the processor AND the payment facilitator, so we’re going to use one of the more common rates we see, which is 2.5% = $0.10. Remember that our imaginary business will process 50 transactions for $1,000 by end of business today. If their Processor/Acquirer is charging 2.5% + $0.10, they will pay $30 in Processing Fees. Here’s what the math looks like: ($1,000*0.13%)+(50*$0.10)=$30. So, our business has now paid $21 in Issuing Bank Fees, $2.36 in Card Network Fees, and $30 in Processing Fees, which means...

So, How Can I Lower my Interchange Fees?

$946.64 out of $1,000 just for one day. That’s 5% of our imaginary business’s profit! While the benefits of accepting credit/debit card payments is HUGE, 5% is significant, especially when you scale it up. For example, let’s say our imaginary business completes 1,000 transactions a month for a total of $20,000, they’ll only be keeping $18,932.80 if we use the same math we used before. That’s a “loss” of $1,067.2. You can see how over time, and at scale, these fees can really add up.

So, if Issuing Bank Fees and Card Network fees are non-negotiable, it’s the Processing/Acquirer fees where you can really save money on Interchange Fees, and Apriva can help you do just that.

Two major benefits of working with PayFacs/Merchant Acquirers are:

- They provide a single point of contact with the complex world of bank and card networks.

- They simplify and streamline the even more complex fee structures banks and card brands charge.

Two major drawbacks of working with PayFacs/Merchant Acquirers are:

- They add their own markup to processing fees, driving them even higher.

- They are considered the merchant by the network of banks and card brands, not you. So, your money isn’t really yours until your Payfac decides to release it to you. So, you’d better be sure your contract is air-tight (often PayFacs can hold your money as long as they want), and you’d better be very confident in their liquidity and stability, aka their ability to pay you, and the likelihood of them going out of business themselves.

Large companies that are able to cut out PayFacs/Merchant Acquirers and work directly with Federally regulated Acquiring Banks, with protective regulations like minimum capital requirements, for their processing needs. But they don’t necessarily get the benefit of a single point of contact and simplified fee structures that a Payfac/Merchant Acquirer can provide. You might be asking, “wouldn’t it be great to have the best of both worlds for any size business?”. Funny you should ask…

Benefits of working directly with Apriva for your Payment Gateway, Payment Acceptance Services, and Processing:

- Your business is the stated merchant on record with the banks and card brands, so Apriva never touches your money, it’s always yours, and it’s paid out by a Federally regulated, liquid, reliable, and trustworthy Acquiring Bank like J.P. Morgan Chase, for example.

- No extra markup on processing fees

- Single point of contact with the complex world of bank and card networks.

- Simplified and streamlined fee structures