Unlocking the Future of Vending: Unattended Payments Trends, Opportunities, and Growth

The Rise of Unattended Payments

Unattended payments encompass a wide range of transactions that occur without human intervention, relying on self-service terminals, kiosks, and other automated technologies. These can vary from simple vending machines in workplace break rooms to fully autonomous grocery stores. Understanding the rapidly evolving landscape of unattended payments, especially in the post-pandemic era, is crucial for businesses seeking to stay competitive and meet growing consumer demand.

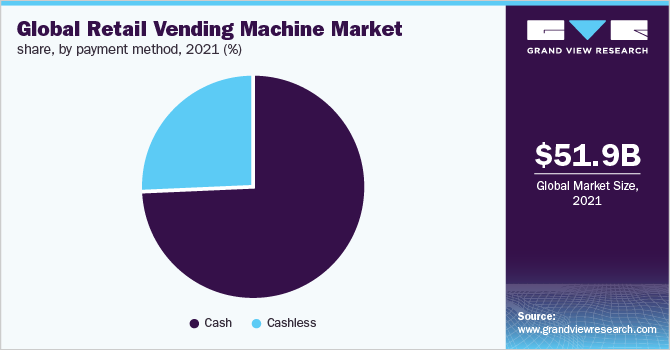

The 2020 pandemic significantly altered consumer payment habits, catalyzing a surge in contactless payments adoption. As one of the main unattended payments trends, it has been an instrumental driver of growth for the industry. The ease and convenience of tapping a phone or a card have made contactless payments a preferred method for many consumers. As a result, businesses must adapt to these evolving customer expectations to remain competitive in today’s market.

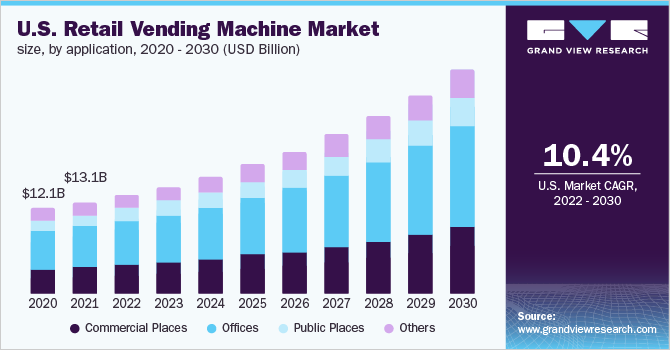

In the past four years, the vending industry experienced a decline due to reduced foot traffic in areas where vending machines are located, such as workplaces, schools, and public transportation hubs. However, it has since rebounded and is gradually returning to pre-pandemic levels. In 2024, the market size of US vending machine operators is $8.6 billion and has been projected to grow steadily over the next five years. Vending machines are just one segment of the broader unattended payments industry, which is projected to reach $129 billion globally by 2030. The industry is showing signs of resilience and growth, benefiting from the rising trends and shifts toward these payment solutions.

The US Vending Operators industry is at an estimated

$8.6 billion in 2024

Recent Developments and Breakthroughs

The evolving unattended payments industry offers numerous opportunities for businesses to thrive. Beyond increasing revenue and cutting operational expenses, businesses should also focus on how to significantly enhance customer experience. Vending machine offerings are virtually limitless, ranging from everyday items like books and fresh baked goods to specialty products like Narcan and car parts. Many businesses might have an opportunity to sell their goods 24/7 with an unattended solution but haven’t realized the possibilities yet. Modern technology allows you to run transactions around the clock, minimize errors, and access real-time data for efficient inventory management and informed decision-making.

Emerging Vending Industry Trends: Key Trends Driving Growth

Increased adoption of EMV-certified devices for secure transactions. In 2023, it was reported that 12.8 billion EMV Chip cards were in global circulation at the end of 2022. That is a 7% increase from the year before. Additionally, 93% of all card-present transactions conducted globally used EMV Chip technology. Meaning, businesses that do not accept contactless payments risk losing customers to competitors who offer this convenient and secure option.

Real-time data analytics have become a crucial tool for modern vending operators. Advanced technology can now sensor inventory levels, track sales performance, and identify product trends with accuracy. By providing this type of data, merchants are equipped with valuable information about products, pricing, and which optimizes revenue and minimizes waste.

From QR codes to digital wallets, contactless payments are being heavily embraced by businesses. Apple Pay, Google Pay, and card tap being some of the most popular. Consumers readily adopt these payment options due to ease and user-friendliness. With this comes rapidly changing customer expectations, which business should embrace and adapt to accept.

The unattended payments industry is projected to reach $129 billion globally by 2030

Types of Businesses Utilizing Vending Unattended Payment Solutions

Retail: Department stores, malls, and small businesses can utilize vending machines to offer replenishing snacks and products for shoppers or stock some of their own products to display them in a refreshing, unique way.

Transportation: Airports, gas stations, train stations, and metro stations have high volumes of people with various needs throughout their travels. Vending items can include healthy food options, electronic devices and accessories, makeup, and travel-sized toiletries.

Hospitality: Vending machines or micro markets are desirable options for guests because they can operate all hours of the day, making them ideal for late nights and early mornings. Apartments can provide machines for both residents and employees. Stocking them with essential supplies, saving users that extra errand to the corner store. Restaurants can extend their offerings through vending machines to provide customers with options before and after business hours, or for quick on-the-go options.

Education: Vending machines can be placed in cafeterias, break rooms, and gyms with food and drinks, libraries with school supplies, and locker rooms and bathrooms with personal hygiene products for students, faculty, and staff.

Corporate: Offices, factories, and campus environments can all benefit from offering wide selections of snacks and drinks for their employees and visitors, and their well-being and productivity.

How Apriva Supports the Unattended Payment Industry

Reliable Payment Partner

Apriva can provide everything you need to accept payments seamlessly and securely. Our advanced features ensure a reliable and efficient payment experience to support growing businesses. Every transaction runs through our secure payment gateway with 99.999% uptime and reliability, and a diversified infrastructure and appropriate safety redundancies built in. You get reduced product waste, more recurring revenue, and tools that help you streamline business management.

The Best Possible Payment Processing Rates

Our payment processing solution sets us apart. Enjoy the convenience of receiving 100% of your revenue upfront while we handle the complexities of fees, compliance, and reporting. Benefit from our relationship with J.P. Morgan Chase for top-notch security, and customized processing rates that guarantee the best possible deal for you. We’re dedicated to your success, offering transparent pricing with no hidden transaction fees. Our commitment to scaling your business means a comprehensive and flexible solution to meet your payment processing needs. Through our wide selection of certified devices and the option to pass on processing fees through cash discounts, you can experience the difference in having the tools and support you need.

EMV-Certified Devices

Apriva’s extensive selection of EMV certifications means your business is equipped with the latest payment technology to run secure and compliant transactions. We continue to connect with our partners, all major acquiring banks, and processors in North America so you have the freedom to mix, match, and change solutions to meet your needs. And, if we don’t already support the processor or device you want to use, we can certify it.

Partnerships with Vending Management Systems Providers

Apriva’s supports a variety of Vending Management Systems (VMS), including VendGogh. VMS software empowers operators to remotely monitor and manage their vending machines, receiving real-time updates on inventory levels, sales data, and machine performance. These insights lead to a better understanding of your machine and information for optimal profitability.

Future-Focused Innovations

Apriva collaborates with leading technology companies who develop cutting-edge vending machines solutions. Through these partnerships, we offer our customers sleeker, user-friendly vending machines that are frictionless, AI-enabled, and customizable. Working with us brings the ability to differentiate your brand in the market and provide consumers with a unique and exciting vending experience.

The good news: there’s an opportunity for vending in almost any industry

The Future of Unattended Payments with Apriva

Unattended payments trends upwards, with acceleration from the added convenience and speed of contactless payments. Coming out of the pandemic, the drive for this market is even higher. The good news: there is an opportunity for vending in almost any industry. With the market’s growing profitability, now is the ideal time to capitalize on these opportunities Thanks to advancements in technology, operating and managing a vending machine has become easier than ever. Even if you’re new to the industry, Apriva can provide the guidance you need. With our comprehensive payment services, processing solutions, EMV certifications, and innovative partners, we are well-equipped to help you succeed in the unattended payments market.

How Apriva Can Help

Apriva has worked with self-service operators like you for over 15 years, and we process over $B+ transactions annually. Meaning, we are market tested and trusted deeply by big names in unattended. But we’re not just a traditional payment processor, we’re a partner dedicated to helping you maximize revenue and stay ahead of the curve. Beyond credit cards, Apriva empowers you to accept a wide range of payment methods, including contactless payments, mobile wallets, and the newest emerging technologies. Offering you ultimate flexibility and choice, you’ll drive sales by accepting any way your customers want to pay. Ready to get in touch and learn more about our vending solutions? Contact us today!