Run a Self-Service Business? Learn How To Lower Processing Fees!

Ever wonder what goes into your credit card processing fees? Who charges what and why? Keep reading if you want to understand the payment flow, know what your credit card processing fees pay for, and learn how to know if you’re paying too much, particularly as it relates to self-service business such as vending machines, micro-markets, kiosks, EV charging, air pumps, car washes, laundry services, parking kiosks, and more. So how do you lower processing fees? Keep reading to find out!

After reading, if you’re still feeling unsure about your rates, or feeling overwhelmed, please reach out to us at pos@apriva.com. We’d be happy to read through your rates and help you understand what you’re actually paying, if you’re getting a good deal, or if there’s room to negotiate – whether it’s with us or not. No strings attached. We are passionate about helping merchants pay the lowest amount possible for good payment services.

Who Does What, and Why?

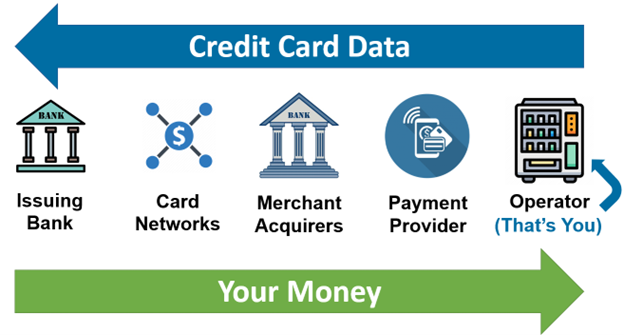

Before we can help you make sure you’re not paying too much, you need to understand who the players in the payment process are – who does what, what they charge, and why. If you want to accept non-cash payments, then there are 4 key players that HAVE to be involved, whether you like it or not. Those are issuing banks, card networks, merchant acquirers, and payment providers. Without them, your customers credit card data can’t be processed and turned into money in your pocket.

Issuing Banks

They issue cards to consumers, and they charge a fee for merchants to accept payments from these cards. Common Issuing Banks include Chase, Bank of America, US Bank, and Wells Fargo. These fees are not negotiable.

Card Networks

They’re the keepers of the system. They set standards, and make sure everyone plays by the rules. They charge merchants a fee to accept payments from these card networks. Common Card Networks include American Express, Discover, Mastercard, and Visa. These fees are not negotiable.

Merchant Aquirers

They’re the keepers of the system. They set standards, and make sure everyone plays by the rules. They charge merchants a fee to accept payments from these card networks. Common Card Networks include American Express, Discover, Mastercard, and Visa. They process non-cash payments on behalf of merchants, for a fee. Common Merchant Acquirers include Chase Paymentech, Elavon, Fiserv, and Global Payments. These fees are negotiable (typically more volume = lower rates).

Payment Providers

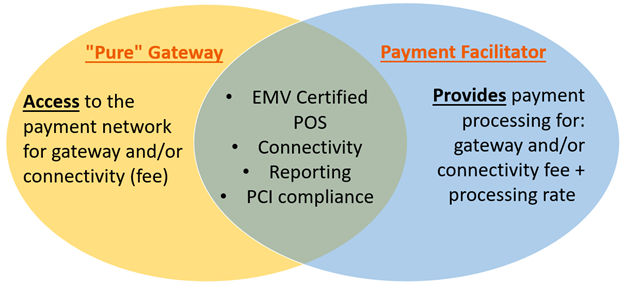

There are typically 2 types of payment providers. Pure gateways, and payment facilitators (also known as a Payfac). A payment gateway and a payment facilitator (Payfac) are both components of the electronic payment processing ecosystem, but they serve different roles. Both provide EMV certified POS devices, connectivity, reporting, and PCI compliance. But there are differences. Before we discuss the differences, know that these fees are 100% negotiable. This is where you can save the most money.

- Payment Gateway: Facilitates transmission of payment data between a merchant and a payment processor. Gateways typically charge monthly and transaction fees, and can often support merchants as they choose and set up a relationship with a payment processor. In fact, many Gateways (like Apriva) have established relationships with many processors and can help ensure merchants get the best processing rates possible. While it’s a little more work for a merchant to use a payment gateway and a processor directly vs. using a payfac, a good gateway will support a merchant through this process, and it can save a lot of money in the long run.

- Payfac: Acts as a middleman between merchants and payment processors. Typically charge monthly, transaction, and processing fees. Payfac’s often charge more than gateways for their services since they’re providing the convenience of setting up these relationships for the merchant.

Who Charges What?

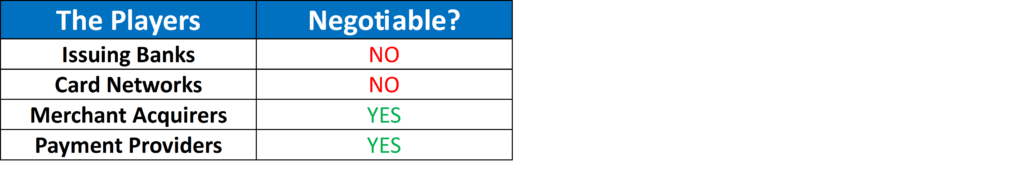

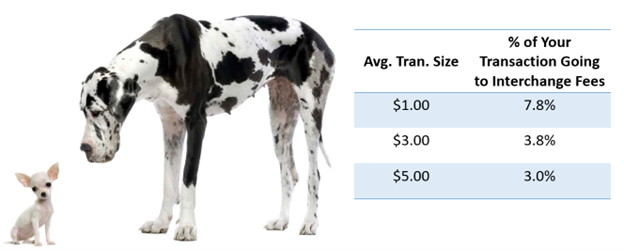

The four players we discussed earlier – issuing banks, card networks, merchant acquirers, and payment providers – all charge fees for their services. Some of these fees are non-negotiable, and some ARE negotiable. Assuming a standard mix of card brands, and average ticket sizes of $5 or less, then you are eligible for small ticket interchange fees. Click here or visit https://payments.apriva.com/how-apriva-can-lower-processing-fees-for-any-size-business/ to learn more about interchange.

What is Small Ticket Interchange Rate, and How Can I Qualify?

Some fees are part of what’s known as “interchange rates”. These are publicly published rates set by card issuers, which change about once a year. As of this blog, the current non-negotiable regular interchange rates are below.

Regular Interchange Rates (as of April 2023):

- 2.12% + $0.12 per transaction for Mastercard

- 2.24% + $0.12 per transaction for Visa

However, did you know these card issuers also offer small ticket interchange rates? Visa and Mastercard have programs that allow providers (like Apriva) to offer special small ticket processing rates. Here at Apriva, we typically offer these rates through JP Morgan Chase, though there are others we can work with. The benefit of a merchant working with Apriva and JP Morgan Chase is that if someone doesn’t have a processor, or they want to switch processors, then we can offer JP Morgan Chase’s promised lower merchant acquirer processing rates, on top of the benefit of the small ticket interchange rates. As of this blog, the current non-negotiable small ticket size interchange rates are below:

Small Ticket Size Interchange Rates (as of April 2023):

- 2.0% + $0.04 for Mastercard

- 2.60% + $0.02 for Visa

So how do you quality for small ticket interchange rates? There are requirements. If a merchant is working with a provider that is authorized to offer these lowered rates – like Apriva – it’s up to them to manage requirements and ensure compliance. So if your payment provider tells you that you qualify, you don’t need to worry too much beyond that. But, for your edification, some requirements include a business having an applicable MCC code, and that a certain percentage of your average ticket sizes remain below a pre-set amount. For example, Visa requires that at least 2/3rds of transactions have an average ticket size of $5 or less. Mastercard has a similar requirement, but average ticket size has to be $7.50 or less. The payment provider offering you these lower interchange rates is responsible for reporting your average ticket sizes every quarter to Visa and Mastercard to ensure eligibility and compliance.

After reading, if you’re still feeling unsure about your rates, or feeling overwhelmed, please reach out to us at pos@apriva.com. We’d be happy to read through your rates and help you understand what you’re actually paying, if you’re getting a good deal, or if there’s room to negotiate – whether it’s with us or not. No strings attached. We are passionate about helping merchants pay the lowest amount possible for good payment services.

What is Small Ticket Interchange Rate, and How Can I Qualify?

Apriva is happy to help! Below we have compiled some of the standard advice we give to merchants when they come to us for support. While we know that in most cases, there’s no one that can beat the value Apriva providers to merchants, you’re free to use this knowledge to shop around and find the best scenario for your business needs.

- Understand Your Small Ticket Size Interchange Rate and Make Sure You’re Actually Getting It.

The average small ticket size interchange rate is 1.8% + 6¢. Remember, “interchange” is the “cost of entry” to accept non-cash payments. Know this, and always check your current or prospective rates against this. If you’re paying much more than this, then someone is adding on to the rates set by issuing banks and card networks, or someone isn’t leveraging small ticket size interchange rates for you, and charging your regular interchange rates instead. - Know Your Average Ticket Size.

Get familiar with your average ticket size! This is so important to understand. If your average ticket size is small enough to qualify for small ticket size interchange rates, then make sure that’s what you’re getting! Also, it’s important to know your average ticket size across your business. If you own multiple vending machines, multiple micro markets, or a mix of both, some machines or locations might have larger or smaller average ticket sizes than the others. There’s absolutely no reason you can’t separate these businesses and seek different payment services for them in order to leverage lower interchange rates! If you have 5 vending machines with a $5 or less average ticket size, and two micro-markets with a $10 average ticket size, then find a way to ensure the vending machines are leveraging small ticket size interchange rates, while micro markets take on the burden of regular interchange rates. Again, if you’re working with a good payment provider (like Apriva!), they will help you navigate this.

3. Read The Fine Print on Offers.

Payment providers, especially Payfac’s and processors, often focus on super low and attractive processing percentage rates, while making it harder to spot additional and super high per transaction fees. If you’re only seeing a percentage based processing fee, dig, read the fine-print, and ask questions until you understand the full picture. This could save you a lot of money!

4. Know The Full Cost of Accepting Credit Cards

This requires some math, so bear with us (or ask us for help). Just like the point above, payment providers try to make their rates look as favorable as possible, which can make it confusing to figure out exactly which offers will keep the most money in your pocket. This is where knowing your average transaction size, and average transactions per month, can really help. If you know these 2 things, you can do the math to figure out what you’re actually paying.

For example, let’s say your average transaction size is $1.75 and you average 127 transactions per month. That’s $222.25 in revenue per month.

- Payment provider A, 1.50% + $14.45/month.

They say they’ll only charge you 1.50%. Sounds great, right? You read the fine print and understand they’ll also be charging you $14.45 per month. Maybe it’s not so bad because of the low percentage, right? How much will you be paying them per month on 127 transactions per month at an average ticket size of $1.75? Answer = $17.77. - Payment Provider B, 5.50% + $5.55/month

This might seem like a better deal. Sure, the percentage fee is higher, but the monthly fee is lower. How much will you be paying them per month on 127 transactions per month at an average ticket size of $1.75? Answer = $17.77. - Payment Provider C, 7.99% + $0/month

This seems like the worst deal, right? Super high percentage fee, so this can’t possibly counteract the $0/month fee, right? How much will you be paying them per month on 127 transactions per month at an average ticket size of $1.75? Answer = $17.77.

- Payment provider A, 1.50% + $14.45/month.

Moral of the story here is to understand the full cost of accepting credit cards, and read the fine print. It’s worth doing a little math so you don’t get tricked into thinking you’re getting a good rate when there is actually room to negotiate.

5. Understand Your Credit Card Data

You know those nice flashy high-rewards cards that earn customers fuel points, plane miles, and more? Do you know who pays for those benefits? You, the merchant. How? Because these high-reward cards come with higher interchange costs. We call this the “high roller effect”. So let’s say you have a vending machine or micro-market in a location where the mix of credit cards being used on your machine has a higher than average ratio of these high reward cards, like an airport or a stadium. That transaction data is going to tell card issuers to charge you higher interchange rates to accept non-cash payments at those locations. What about your other locations that have a standard mix of credit card data, and DO qualify for small ticket interchange rates? They’ll also be held to the higher interchange rates of the “high roller effect” locations unless you separate them. Meaning, analyze your credit card data and if some locations have higher than average transaction sizes, or higher interchange rates, then you can either get those locations on different payment provider plans, and possibly increase rates at specific locations to combat those higher fees.

We hope this helps! Whether you’re choosing to work with Apriva, or someone else, make sure you’re getting the best deal possible in order to accept non-cash payments at your self-service business. And remember, we’re always happy to help merchants double check their rates and make sure they’re not over-paying for these services with no strings attached. Because it’s the right thing to do, and what a good helpful gateway does (that’s us). Contact us today to learn more!

Give us a chance to show you the Apriva difference today. Contact Apriva today for more information!